Tssl (trailing stop / stop limit)

Set a range to trail for better entry or exit points, by following prices while they are moving down- or upwards. This way Gunbot won't trade while prices are still moving in the same direction.

Trading example

Example of how trading with this strategy can perform. Details and settings

How to work with this strategy

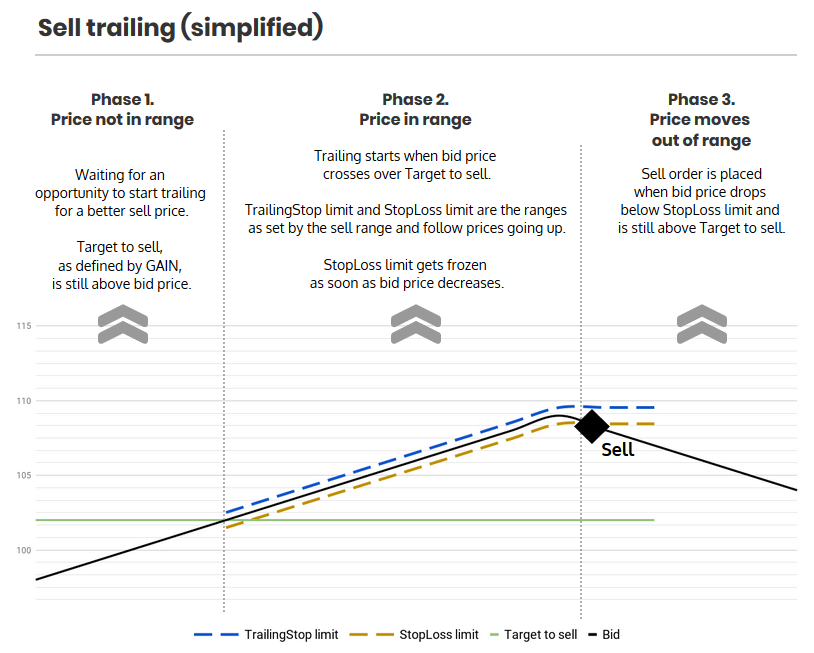

The infographics below describes what triggers trades with this strategy.

You can select an option to only sell at profit, to avoid the risk of a stop limit sell at loss while you're still in the initial range around bought price. This is called TSSL_TARGET_ONLY.

Minimum profit =

tssl-SELL_RANGE

You can optionally use additional indicators like RSI for extra confirmation on entry and exit points.

Strategy parameters

Following settings options are available for tssl and can be set in the strategy configurator of the GUI or the strategies section of the config.js file.

These settings are global and apply to all pairs running this strategy. When you want a specific parameter to be different for one or more pairs, use an override at the pair level.

Using the BUY_METHOD and SELL_METHOD parameters you can combine different methods for buying and selling. This strategy page assumes both BUY_METHOD and SELL_METHOD are set to tssl. Accepted values are all strategy names as listed here.

Buy settings

Buy settings are the primary trigger for buy orders. These parameters control the execution of buy orders when using tssl as buy method.

Buy enabled

Set this to false to prevent Gunbot from placing buy orders.

Values: true or false

Default value: true

Affects

Does not affect

Strategy buy

Strategy sell

DCA buy

Stop limit

RT buy

Close

RT buyback

RT sell

Parameter name in config.js: BUY_ENABLED

Buy Level

This sets the minimum target for buy trailing at a percentage below the lowest EMA. Trailing must finish below this level.

When you set this to 1, trailing for a buy order must finish at least 1% below the lowest EMA.

Values: numerical, represents a percentage.

Default value: 1

Affects

Does not affect

Strategy buy

Strategy sell

Stop limit

Close

RT sell

DCA buy

RT buy

RT buyback

Parameter name in config.js: BUY_LEVEL

Buy Range

This sets the buy range for trailing.

Setting a range of 0.5% at a starting price of 0.1 would set a range between 0.0995 and 0.1005.

As long as prices keep moving downwards, the range moves down along with the price. As soon as prices start going upward, the range freezes and a buy order is placed when the price crosses the upper boundary of the range.

Values: numerical, represents a percentage.

Default value: 0.5

Affects

Does not affect

Strategy buy

Strategy sell

Stop limit

Close

RT sell

DCA buy

RT buy

RT buyback

Parameter name in config.js: BUY_RANGE

NBA

"Never Buy Above". Use this to only allow buy orders below the last sell rate.

This sets the minimum percentage difference between the last sell order and the next buy. The default setting of 0 disables this option.

When set to 1, Gunbot will only place a buy order when the strategy buy criteria meet and price is at least 1% below the last sell price.

Values: numerical, represents a percentage.

Default value: 0

Affects

Does not affect

Strategy buy

Strategy sell

Stop limit

Close

RT sell

DCA buy

RT buy

RT buyback

Parameter name in config.js: NBA

Take Buy

With this setting enabled, Gunbot will try to take any buy chance between the strategy entry point and your setting for TBUY_RANGE.

As soon as the ask price drops below the upper border of this range (called "Take Buy"), it will trail down with a range of TBUY_RANGE and place a buy order as soon as the ask price crosses up "Take Buy". Confirming indicators in use are respected.

Normal strategy buy orders are still possible while using TAKE_BUY.

This option should not be used together with reversal trading.

Values: true or false

Default value: false

Affects

Does not affect

Strategy buy

Strategy sell

Stop limit

Close

RT sell

DCA buy

RT buy

RT buyback

Parameter name in config.js: TAKE_BUY

TBuy Range

This sets the buy range for TAKE_BUY.

When set to 0.5, the initial trailing stop is set 0.5% above the entry point defined by BUY_LEVEL.

Values: numerical, represents a percentage.

Default value: 0.5

Affects

Does not affect

Strategy buy

Strategy sell

Stop limit

Close

RT sell

DCA buy

RT buy

RT buyback

Parameter name in config.js: TBUY_RANGE

Sell settings

Sell settings are the primary trigger for sell orders. These parameters control the execution of sell orders when using tssl as sell method.

Sell enabled

Set this to false to prevent Gunbot from placing sell orders.

Values: true or false

Default value: true

Affects

Does not affect

Strategy sell

Strategy buy

Stop limit

RT buy

RT sell

RT buyback

Close

DCA buy

Parameter name in config.js: SELL_ENABLED

Gain

This sets the starting point for sell trailing. Gunbot will start trailing once price reaches the set percentage above the break-even point.

When you set this to 1, trailing for a sell order starts when price reaches a point 1% above the average bought price.

Values: numerical – represents a percentage.

Default value: 0.5

Affects

Does not affect

Strategy sell

Strategy buy

RT buy

RT buyback

RT sell

Close

DCA buy

Stop limit

Parameter name in config.js: GAIN

Sell Range

This sets the sell range for trailing.

Setting a range of 0.5% at a starting price of 0.1 would set a range between 0.0995 and 0.1005.

As long as prices keep moving upwards, the range moves up along with the price. As soon as prices start going downward, the range freezes and a sell order is placed when the prices crosses the lower boundary of the range.

Values: numerical – represents a percentage.

Default value: 0.5

Affects

Does not affect

Strategy sell

Strategy buy

RT buy

RT buyback

RT sell

Close

DCA buy

Stop limit

Parameter name in config.js: SELL_RANGE

Take Profit

With this setting enabled, Gunbot will try to take any possible profit between the break-even point and your strategy exit point. This can be useful, for example, on days where the markets move very slowly.

It works by trailing prices upwards between the break-even point and the strategy exit point, with a configurable range for trailing: TP_RANGE. A sell order will be placed when the trailing stop limit is hit or strategy sell conditions are reached. Confirming indicators in use are respected.

Sells at minimal loss are possible when using TAKE_PROFIT, acting as a sort of mini stop loss.

This option should not be used together with reversal trading or DOUBLE_CHECK_GAIN

Values: true or false

Default value: false

Affects

Does not affect

Strategy sell

Strategy buy

RT buy

RT buyback

RT sell

Close

DCA buy

Stop limit

Parameter name in config.js: TAKE_PROFIT

TP Range

This sets the sell range for TAKE_PROFIT.

When set to 0.5, the initial trailing stop is set 0.5% below the break-even point.

Values: numerical – represents a percentage.

Default value: 0.5

Affects

Does not affect

Strategy sell

Strategy buy

RT buy

RT buyback

RT sell

Close

DCA buy

Stop limit

Parameter name in config.js: TP_RANGE

TP Profit Only

Enable this to only allow sell orders above the break-even point.

Values: true or false

Default value: false

Affects

Does not affect

Strategy sell

Strategy buy

RT buy

RT buyback

RT sell

Close

DCA buy

Stop limit

Parameter name in config.js: TP_PROFIT_ONLY

Double Check Gain

This is an extra check that looks at your recent trading history to verify GAIN will be reached before placing a sell order.

Values: true or false

Default value: true

Affects

Does not affect

Strategy sell

Strategy buy

RT buy

RT buyback

RT sell

Close

DCA buy

Stop limit

Parameter name in config.js: DOUBLE_CHECK_GAIN

Indicator settings

Relevant indicators for trading with tssl.

These settings have a direct effect on trading with tssl, because BUY_LEVEL is dependant on EMA.

Period

This sets the candlestick period used for trading, this affects all indicators within the strategy.

Only use supported values.

Setting a short period allows you to trade on shorter trends, but be aware that these will be noisier than longer periods.

Values: numerical– represents candlestick size in minutes.

Default value: 15

Affects

Does not affect

Strategy sell

RT buy

Strategy buy

RT buyback

DCA buy (when using an indicator to trigger)

RT sell

Close

Stop limit

Parameter name in config.js: PERIOD

Slow EMA

Set this to the amount of candlesticks you want to use for your slow EMA. The closing price for each candle is used in the slow EMA calculation.

For example: when you set PERIOD to 5, and want to use 2h for slow EMA – you need to set EMA1 to 24 (24 * 5 mins).

Values: numerical – represents a number of candlesticks.

Default value: 16

Affects

Does not affect

Strategy buy

RT buy

RT buyback

RT sell

Close

Stop limit

Strategy sell

DCA buy

Parameter name in config.js: EMA1

Medium EMA

Set this to the amount of candlesticks you want to use for your medium EMA. The closing price for each candle is used in the fast EMA calculation.

For example: when you set PERIOD to 5, and want to use 1h for medium EMA – you need to set EMA2 to 12 (12 * 5 mins).

Values: numerical – represents a number of candlesticks.

Default value: 8

Affects

Does not affect

Strategy buy

RT buy

RT buyback

RT sell

Close

Stop limit

Strategy sell

DCA buy

Parameter name in config.js: EMA2

TrailMe settings

Parameters to configure additional trailing for various types of orders. Trailing works just like it does for the TSSL strategy, the difference being the starting point of trailing.

Because tssl already trails for buy and sell orders, there is no benefit of enabling further trailing for strategy buy or sell orders.

TrailMeBalance settings

Balance settingsConfirming indicator + advanced indicator settings

Confirming indicatorsDollar cost avg settings

Dollar Cost Avg (DCA)Reversal trading settings

Reversal trading (RT)Misc settings

Misc settingsPlaceholders

The following parameters in config.js have no function for this strategy and act as placeholder.

Parameter

Description

ATRX

Placeholder.

ATR_PERIOD

Placeholder.

BUYLVL1

Placeholder.

BUYLVL2

Placeholder.

BUYLVL3

Placeholder.

BUYLVL

Placeholder.

DISPLACEMENT

Placeholder.

FAST_SMA

Placeholder.

HIGH_BB

Placeholder.

ICHIMOKU_PROTECTION

Placeholder.

KIJUN_CLOSE

Placeholder.

KIJUN_PERIOD

Placeholder.

KIJUN_STOP

Placeholder.

KUMO_CLOSE

Placeholder.

KUMO_SENTIMENTS

Placeholder.

KUMO_STOP

Placeholder.

LEVERAGE

Placeholder.

LONG_LEVEL

Placeholder.

LOW_BB

Placeholder.

MACD_LONG

Placeholder.

MACD_SHORT

Placeholder.

MACD_SIGNAL

Placeholder.

MAKER_FEES

Placeholder.

MEAN_REVERSION

Placeholder.

PP_BUY

Placeholder.

PP_SELL

Placeholder.

PRE_ORDER_GAP

Placeholder.

PRE_ORDER

Placeholder.

RENKO_ATR

Placeholder.

RENKO_BRICK_SIZE

Placeholder.

RENKO_PERIOD

Placeholder.

ROE_CLOSE

Placeholder.

ROE_LIMIT

Placeholder.

ROE_TRAILING

Placeholder.

ROE

Placeholder.

SELLLVL1

Placeholder.

SELLLVL2

Placeholder.

SELLLVL3

Placeholder.

SELLLVL

Placeholder.

SENKOUSPAN_PERIOD

Placeholder.

SHORT_LEVEL

Placeholder.

SLOW_SMA

Placeholder.

TENKAN_CLOSE

Placeholder.

TENKAN_PERIOD

Placeholder.

TENKAN_STOP

Placeholder.

USE_RENKO

Placeholder.

Last updated

Was this helpful?